To transfer money from DistroKid to your own bank account can be confusing and you will not get specific advice when asking the DistroKid support which can be really frustrating. There are also some hidden fees to watch out for which means you could save hundreds of dollars with some creativity.

In this article we will share some insights and will give value mainly for artists living outside the U.S. and will answer questions like:

- What are the DistroKid payment methods?

- How do you withdraw money from DistroKid?

- How to get rid of the 30% withholding tax?

- How do I fill out a DistroKid tax form? Should I use W8-BEN or W8-BEN-E form?

- What is the cheapest way to transfer money from DistroKid to your country?

Disclaimer

Taxes for musicians can be a complicated matter. We are a Record Label from Sweden and we are no tax consultants and have only used these strategies and examples which have worked for us and for the artists we have instructed. Your specific case might be different depending on your situation like country of residence, age and other factors. Please consult a tax lawyer if you want professional advice.

What are the ways to withdraw money from DistroKid?

DistroKid uses a payment workflow provider called Tipalti and you can choose one of these payment methods below. BUT, these are not the only fees involved:

Tipalti Fees DistroKid

- ACH (the U.S. only) — Also known as “direct deposit.” The money goes straight into your bank account. This is how most employers in the U.S. pay their employees. Fee is only $1 per payment.

- eCheck (U.S.) — This is like ACH, but reflects as a check in your bank account. $1.50 per payment.

- eCheck (non-U.S.) — Same as eCheck above, but $5.00 per payment.

- Check — That’s right! We can mail you a paper check. Old school, keepin’ it real. $3 per check.

- PayPal — Fast, cheap, works in most countries. $1 plus 2% of the payment amount with a total ceiling of $2 in the U.S. or $21 outside the U.S. Amounts over $10,000 will be split into separate payments.

- Wire Transfer (U.S.) — $15 per payment.

- Wire Transfer (International in local currency) — $20 per payment.

- Wire Transfer (International in USD) — $26 per payment.

According to DistroKid’s website, these are the options and fees. However, they don’t include the foreign exchange rate (fx) which means there are some serious hidden fees (not from DistroKid) but from the service providers which will eat up your hard-earned royalties.

For non-U.S citizens/Organizations, depending on which payment methods you choose your cost will vary between 3.5%(!) – 5.1%(!!) or $31 – $51 if transferring $1000.

But there is a better way!

In this article, we will explain a creative solution, you only need to set up once, for international transfers to reduce this to only around 0.74% or $7.4 for a transfer of $1000.

What is the cheapest way to withdraw money from DistroKid? A cost comparison table (US and Internationally)

If you are an American citizen, you will do fine without our solution. A transfer from DistroKid will cost you no more than $1 if you choose the ACH method directly to your bank account.

If you live outside the U.S. you need to think about which payment method you choose in order to not waste money on bank transfers and foreign exchange rates.

Here’s a cost comparison of withdrawal fees of all payment methods on DistroKid

What |

Region |

Description |

Fees + hidden fees |

Actual cost for sending $1000 |

| ACH | The U.S only | “Direct deposit.” The money goes straight into your bank account if you are a U.S. citizen. This is how most employers in the U.S. pay their employees. If you live in U.S. congratulations! | $1 per payment | $1 |

| eCheck | The U.S only | This is like ACH, but reflects as a check in your bank account. $1.50 per payment. | $1.5 per payment | $1.5 |

| eCheck | non-U.S | Same as eCheck above, but $5.00 per payment. | $5 + fx rate (depending on the bank) | from $35 – up to $65 |

| Check | The U.S. only(?) | DistroKid can mail you a paper check. Old school and cool! | $3 | $33-63 if your bank accepts checks internationally |

| PayPal | International | Fast and convenient, but not cheap if you are outside the U.S. It works in most countries. $1 plus 2% of the payment amount with a total ceiling of $2 in the U.S. or $21 outside the U.S. Amounts over $10,000 will be split into separate payments. | U.S – $1 + 2%Int. $1 + 2% + fx rates! | U.S – $2International currency – $60 |

| Wire Transfer | U.S | Wire Transfer | $15 | $15 |

| Wire Transfer | Non-U.S resident paid in non-USD | (International in local currency) — $20 per payment. | $20 + fx rates | $60 |

| Wire Transfer | Non-U.S resident paid in USD | (International in USD) — $26 per payment. + Foreign Exchange Rate 2,5% under $5000 or 1,9% over $5000 | $26 + 2.5% < $5000$26 + 1.9% > $5000 | $51 |

| Creative Solution ACH + Wise | International | Get a US ACH account with Wise to send money from DK for $1, then send money internationally with the cheapest option on the market. | $1 + Wise exchange rate | $7.4 |

And the winning solution for best international transfer = ACH + Wise!

The cheapest way to transfer royalties from DistroKid to the UK, France, Sweden, Japan, and internationally

The cheapest way to withdraw money from DistroKid is ACH + Wise.

This setup is pretty straightforward but will require a Wise account which is free of charge. This will give you two advantages:

- Access to an ACH account means you can transfer money for $1

- The ability to transfer money internationally with the market’s lowest fx-rate will save around $30-$50 per transfer if sending $1000. Meaning your total fees will be around $7.4. or 0.74%.

Here’s how you set it up in DistroKid. You will need:

- A Wise account (previously called TransferWise). Create an account before you start this guide. It’s free.

- Your ACH details from Wise: Routing Code, Account Number, Address

- Evidence of citizenship or registration number (for organizations)

Let’s start:

Go to DistroKid Payouts

https://distrokid.com/payouts

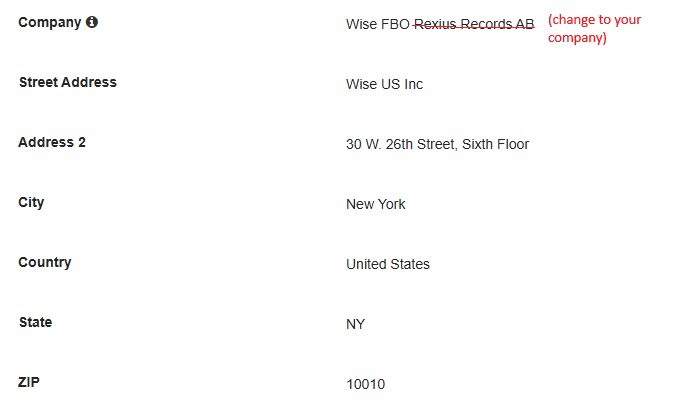

Set the address to the American Wise address

This step is important and may be counterintuitive. You need to set the bank address here instead of your home address in order for the ACH payment method to show up in the next step.

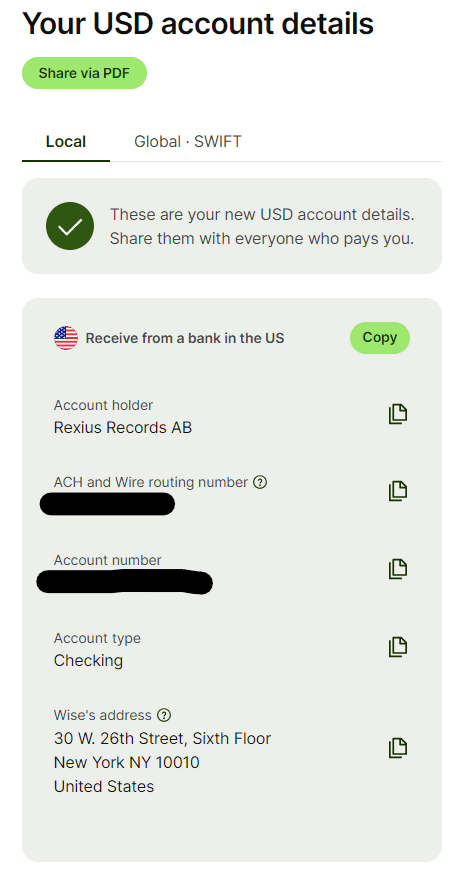

You’ll find your bank details in Wise after logged in: https://wise.com/account/account-details.

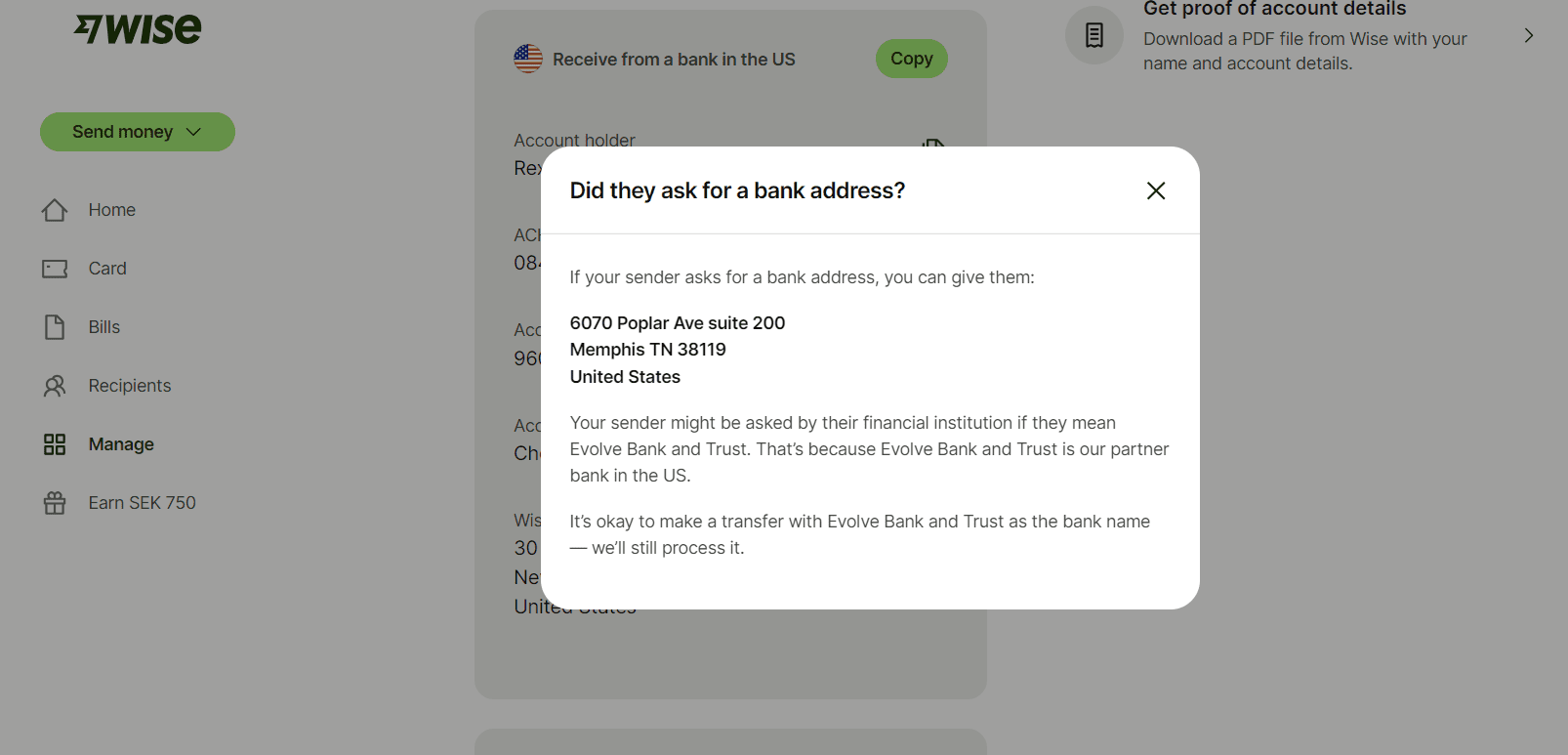

Then click on the question mark and this popup will show where you will find the bank address:

The fill in your details. The bank address and details can be different for different accounts (business vs private) and can be changed over time. So make sure to actually check your own account.

Alternative way:

Some distributors using Tipalti (Symphonic, OneRPM) may require you to set your contact address to your actual address, and then change a backend setting for you to “allow payment from any country”.

If your payment details are rejected, when using the above method, please reach out to the support, and ask them to change the setting above within Tipalti. Then, after they have updated the setting, a new checkbox will appear below the Address details “to be paid in a different country”, then select “United States” to receive the ACH payment.

Choose payment method

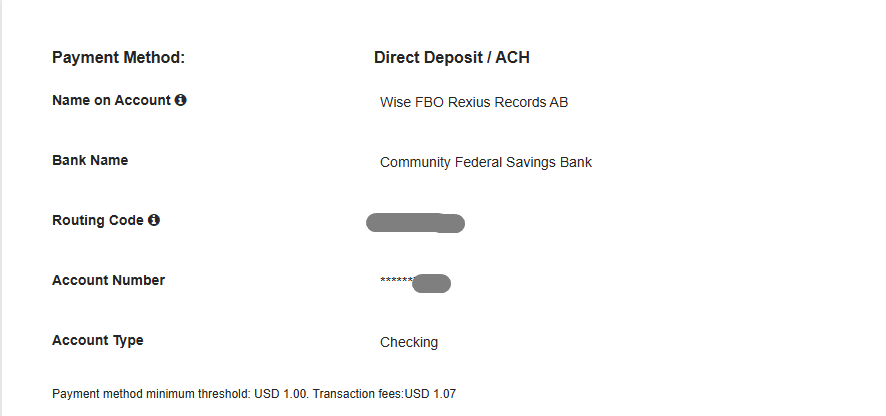

Choose Direct Deposit / ACH. Fill in the form.

Get your bank details again. Make sure to actually check your own account details and bank name.

Here are some variations we have seen on Bank Names for Wise:

- Wise US Inc / JP Morgan Chase Bank

- TransferWise

- Evolve Bank and Trust

- Community Federal Savings Bank

If your account type is Deposit in Wise, then choose Checking at Tipalti / DistroKid. (You can only choose between Savings and Checking). Here’s Wise support confirming this to a user.

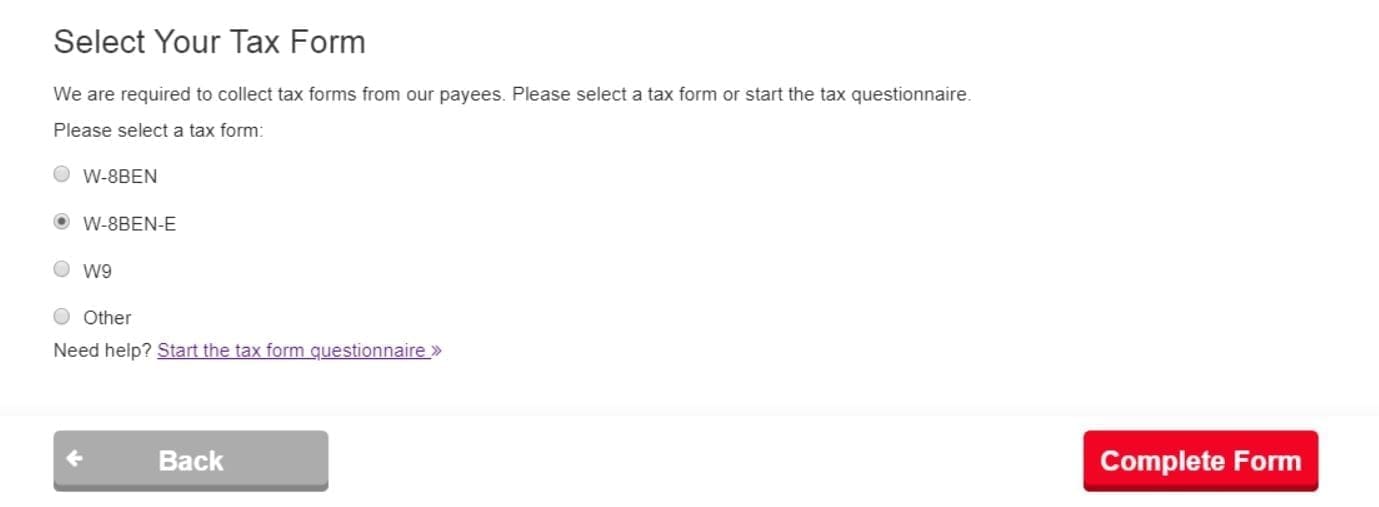

Choose tax form

Choose what’s applicable for you. We will show what’s applicable for us, a business in Sweden. Please refer to our section about W8-BEN further down this guide if you are a private person.

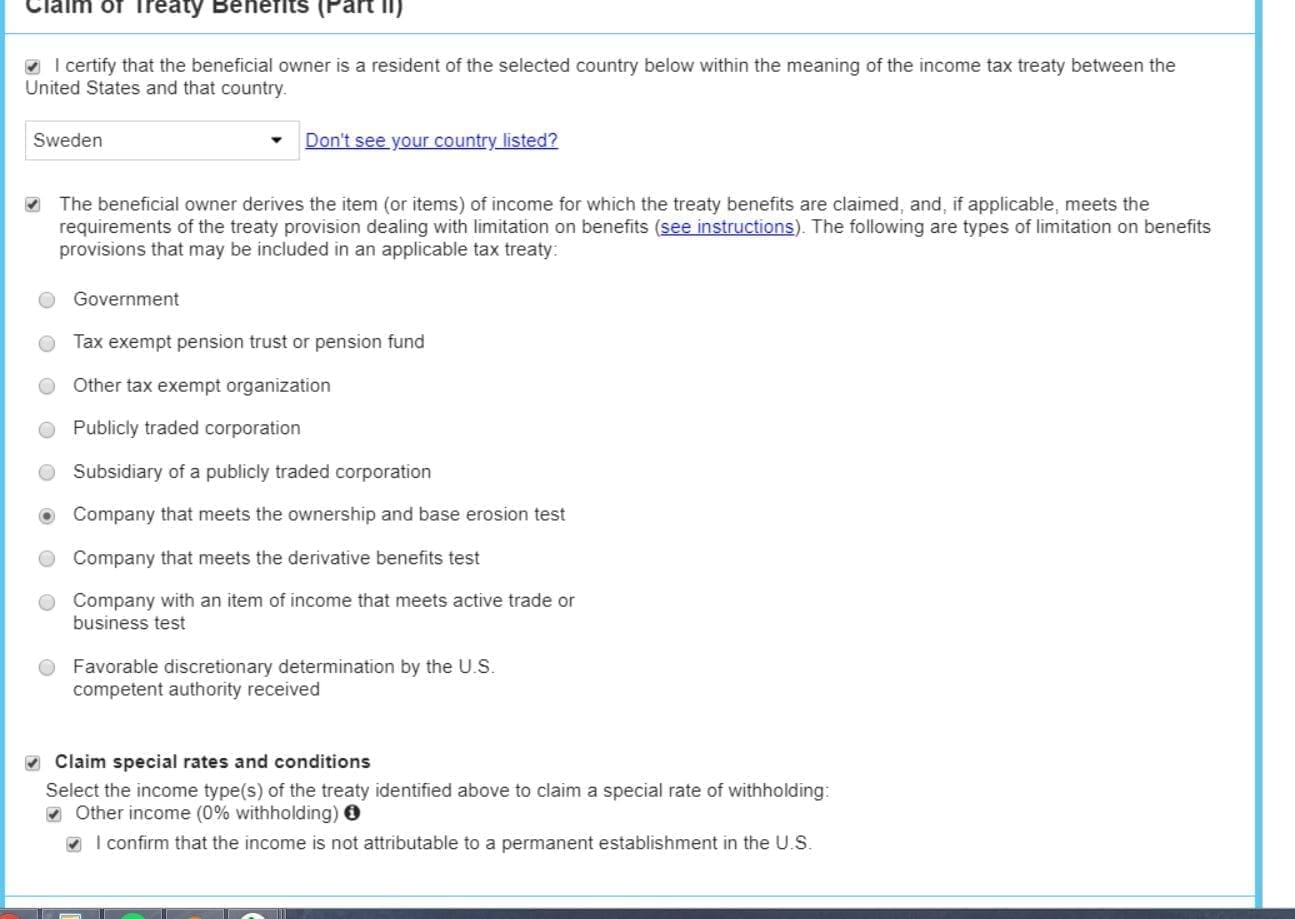

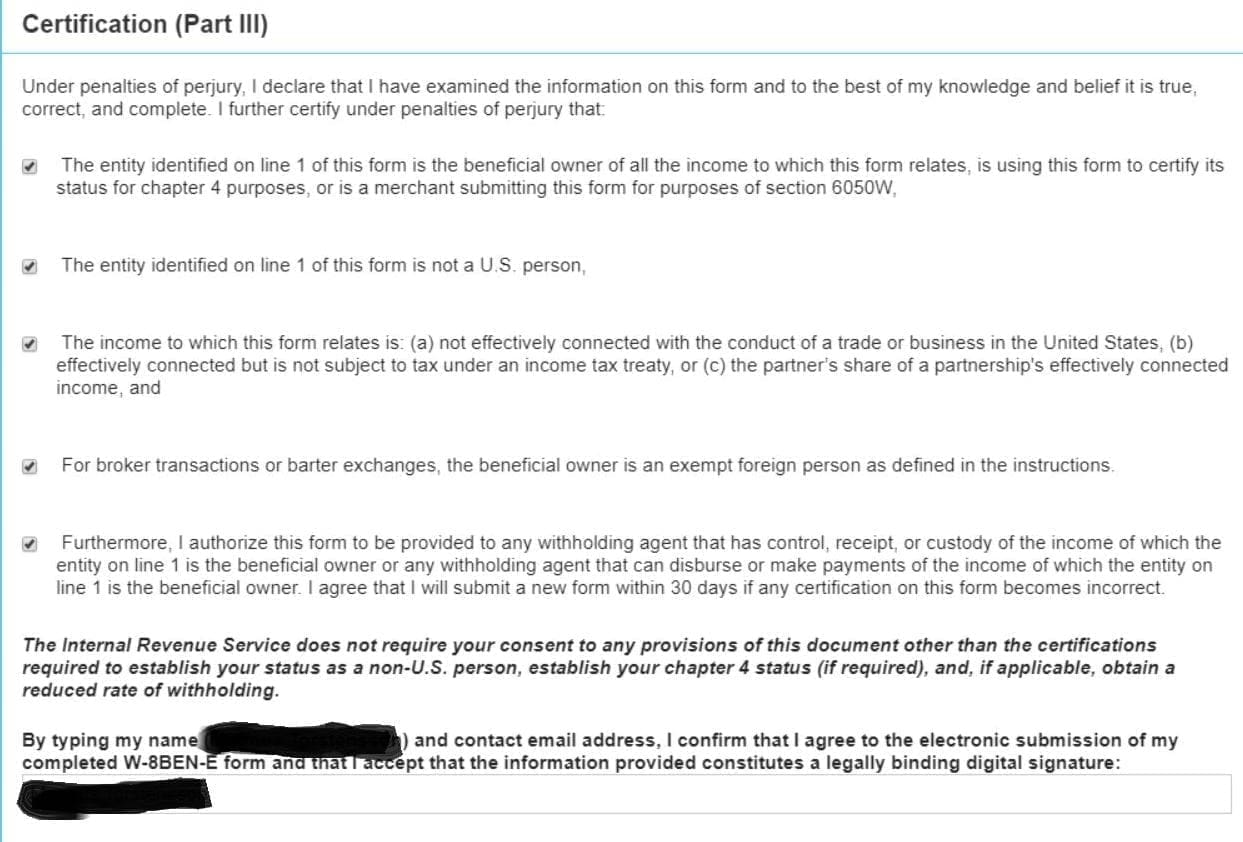

Fill in W8-BEN or W8-BEN-E claim of treaty benefits

We are not able to give advice on how or when you should file your taxes. Contact a tax professional for any questions or recommendations.

Fill in your tax residence (probably where you live most days of the year). Fill in what’s applicable to you. Note that we are only giving you what’s applicable to us.

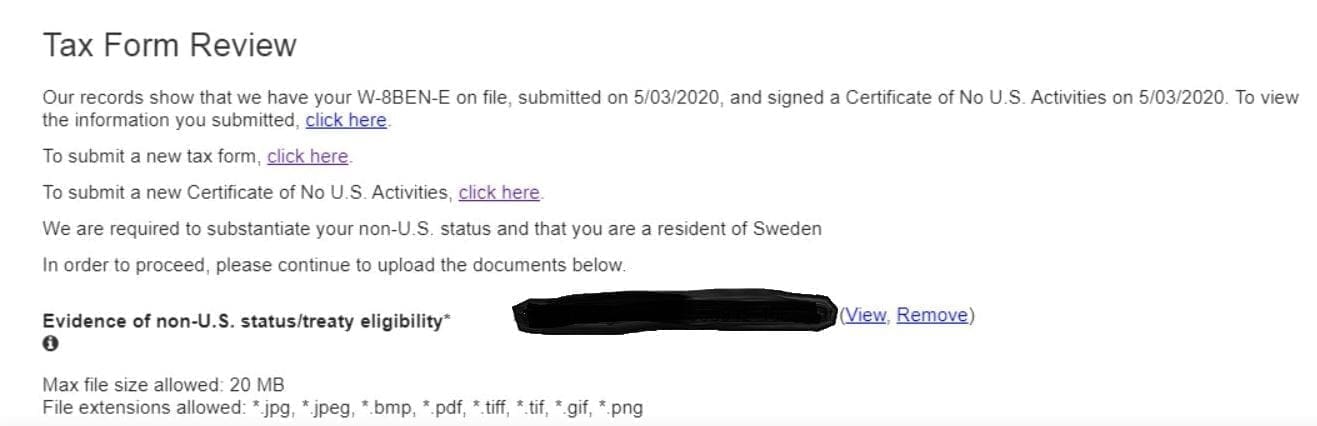

Submit evidence and review

Provide evidence. We used the Registration Document for our business. Make sure it’s updated.

How long will it take to transfer money from DistroKid?

When you have filled in the form, you are ready to withdraw the money.

Go to distrokid.com/bank and click on the obvious “Withdraw earnings” button. DistroKid will send your royalties to your Wise account. This will usually just take a few days. However, DistroKid says it can take 1-14 days.

When your money has arrived in your Wise account. You are ready to send money overseas to your normal bank account. It’s pretty self-explanatory but here’s their guide if you are unsure:

https://wise.com/help/articles/2977959/how-do-i-send-money-with-wise

When does DistroKid pay?

Your royalty earnings will be available as soon as the music services report to DistroKid. The most common music services and their reporting schedule to DistroKid are:

Music Service |

Delay |

Time of month |

| Spotify | 2 months | around 28th |

| Apple Music / iTunes | 1,5 months | around 15th |

| Soundcloud | 1-1,5 months | around 5th |

| Beatport | 1-1,5 months | around 5th |

| Amazon | 2-2,5 months | around 1st |

| Deezer | 4 months | around 28th |

Then DistroKid makes payment 2 times per week and then it takes some time for the transaction to actually arrive at your destination depending on your payment method.

How to get rid of 30% withholding tax from DistroKid

Many artists assume that DistroKid has robbed them of 30% of their royalties but this is something that they are required to do according to U.S laws. If you are a non U.S resident you can get rid of the 30% tax with some simple steps. This is only applicable if your country has a tax treaty with the United States (many do).

The first time or once a year you will be prompted when making a withdrawal in your DistroKid bank to fill in the tax form applicable to you.

For organizations→ Fill in the W8-BEN-E tax form

If Individual → Fill in the W8-BEN

Which countries have treaty benefits with the United States?

If you live in one of the countries listed below you can claim treaty benefits (2021):

Armenia, Australia, Austria, Azerbaijan, Bangladesh, Barbados, Belarus, Belgium, Bulgaria, Canada, China, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Greece, India, Hungary, Iceland, Indonesia, Ireland, Israel, Italy, Jamaica, Japan, Kazakhstan, Kyrgyzstan, Latvia, Lithuania, Korea (South), Luxembourg, Mexico, Malta, Moldova, Morocco, Netherlands, New Zealand, Norway, Pakistan, Philippines, Poland, Portugal, Romania, Russian Federation, Slovakia, Slovenia, South Africa, Spain, Sri Lanka, Sweden, Switzerland, Tajikistan, Thailand, Tunisia, Trinidad and Tobago, Turkey, Turkmenistan, Ukraine, United Kingdom, United States, Uzbekistan, Venezuela

Note: We are not able to give advice on how or when you should file your taxes. We recommend that you contact a tax professional for any questions or recommendations.

Payment and Withdrawal FAQs

Does DistroKid have any hidden fees?

DistroKid itself does not charge hidden fees for withdrawals. However, payment processors (PayPal, Tipalti) may apply their own fees, including transaction costs and currency exchange fees. Always check these clearly before initiating a withdrawal.

How do I fill out the DistroKid tax form if I’m from the UK?

If you’re an individual artist, submit Form W-8BEN.

If you’re registered as a company or label, submit Form W-8BEN-E.

- These forms are required to certify that you’re not a U.S. resident and to claim treaty benefits under the US–UK tax treaty, which typically reduces the default 30% withholding tax to 0%.

- You fill out this form in the “Tax Info” section of your DistroKid dashboard, via Tipalti.

How do I fill out the DistroKid tax form if I’m from Germany?

- Individuals must submit W-8BEN.

- Companies (e.g., a UG, GmbH, or other legal entity) must submit W-8BEN-E.

Germany has a tax treaty with the U.S., which typically reduces your withholding tax to 0%, assuming the form is correctly completed.

Which DistroKid tax form should Canadian artists submit?

- Individuals must submit W-8BEN.

- Companies (e.g., a UG, GmbH, or other legal entity) must submit W-8BEN-E.

Germany has a tax treaty with the U.S., which typically reduces your withholding tax to 0%, assuming the form is correctly completed.

What tax form does DistroKid require for artists based in France?

- Individual artists: Use W-8BEN.

- Companies (e.g., SAS, SARL): Use W-8BEN-E.

Filling out the correct form allows you to benefit from the US–France tax treaty, typically lowering the withholding rate to 0%. DistroKid submits this to the IRS via Tipalti once completed.

How to withdraw money from DistroKid in Nigeria?

You can withdraw funds using:

- Payoneer (recommended due to local compatibility and lower fees)

- Wire transfer via Tipalti

- eCheck/local bank transfer (if supported)

- PayPal (only available if your Nigerian PayPal account can receive funds)

For taxes:

- If you’re an individual, complete the W-8BEN form.

- If you’re operating through a registered business, use W-8BEN-E.

Unfortunately, Nigeria does not have a tax treaty with the U.S., so the standard 30% withholding may still apply.

🇸🇪 Sweden: What tax form do I need as an artist from Sweden?

- If you’re an individual, submit Form W-8BEN.

- If you’re a company (e.g., AB or HB), submit Form W-8BEN-E.

Sweden has a treaty with the U.S. that generally reduces withholding tax from 30% to 0%, assuming you fill out the form correctly and claim the treaty benefits.